RAISING THE BAR

Our mission is to provide unparalleled transparency & accountability, guaranteeing traceability of SMO Gold throughout the supply chain. We are proud to introduce the SMO ESG Benchmark - a pioneering initiative to evaluate the sustainability credentials of gold mining operations.

INTRODUCING

SMO ESG BENCHMARK

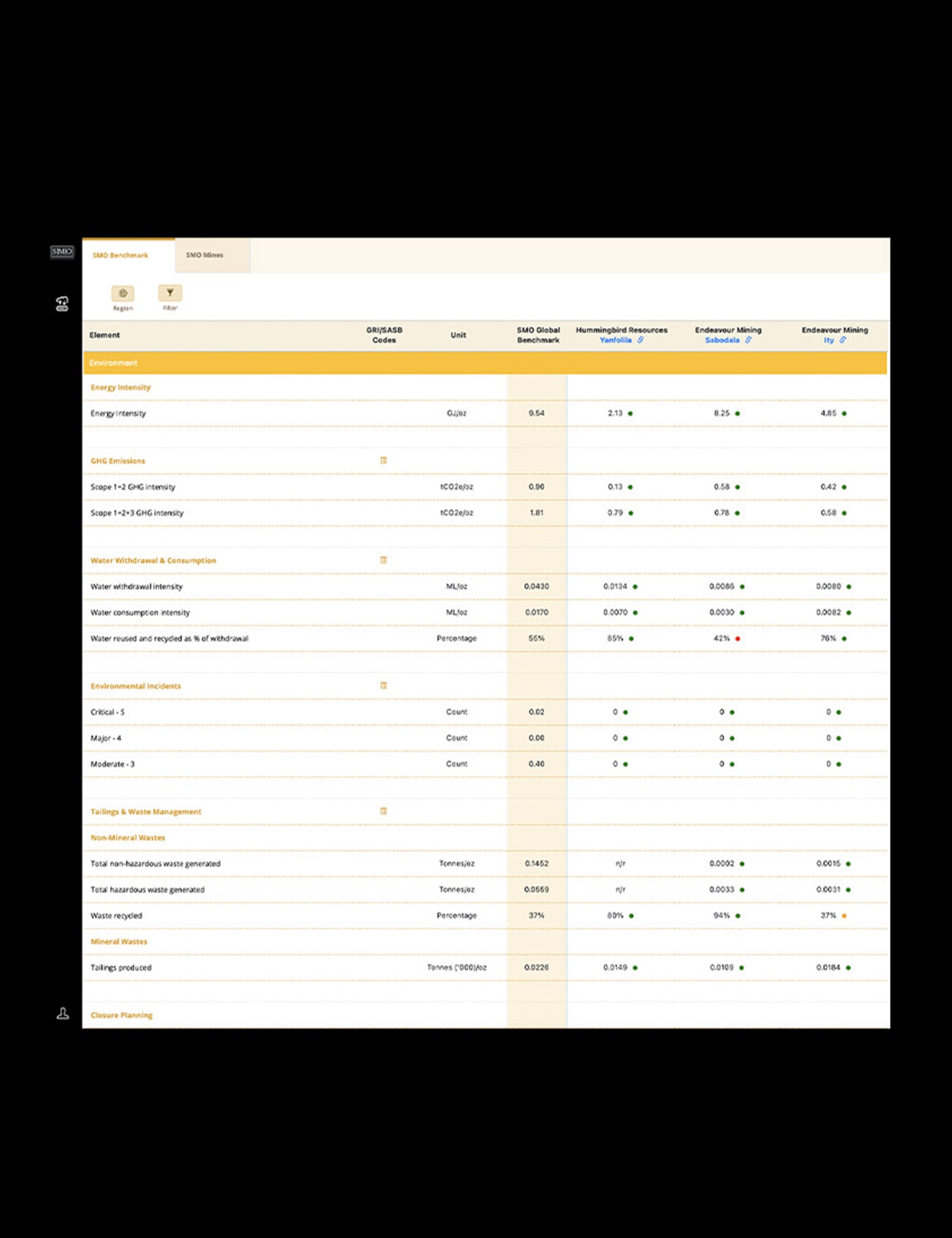

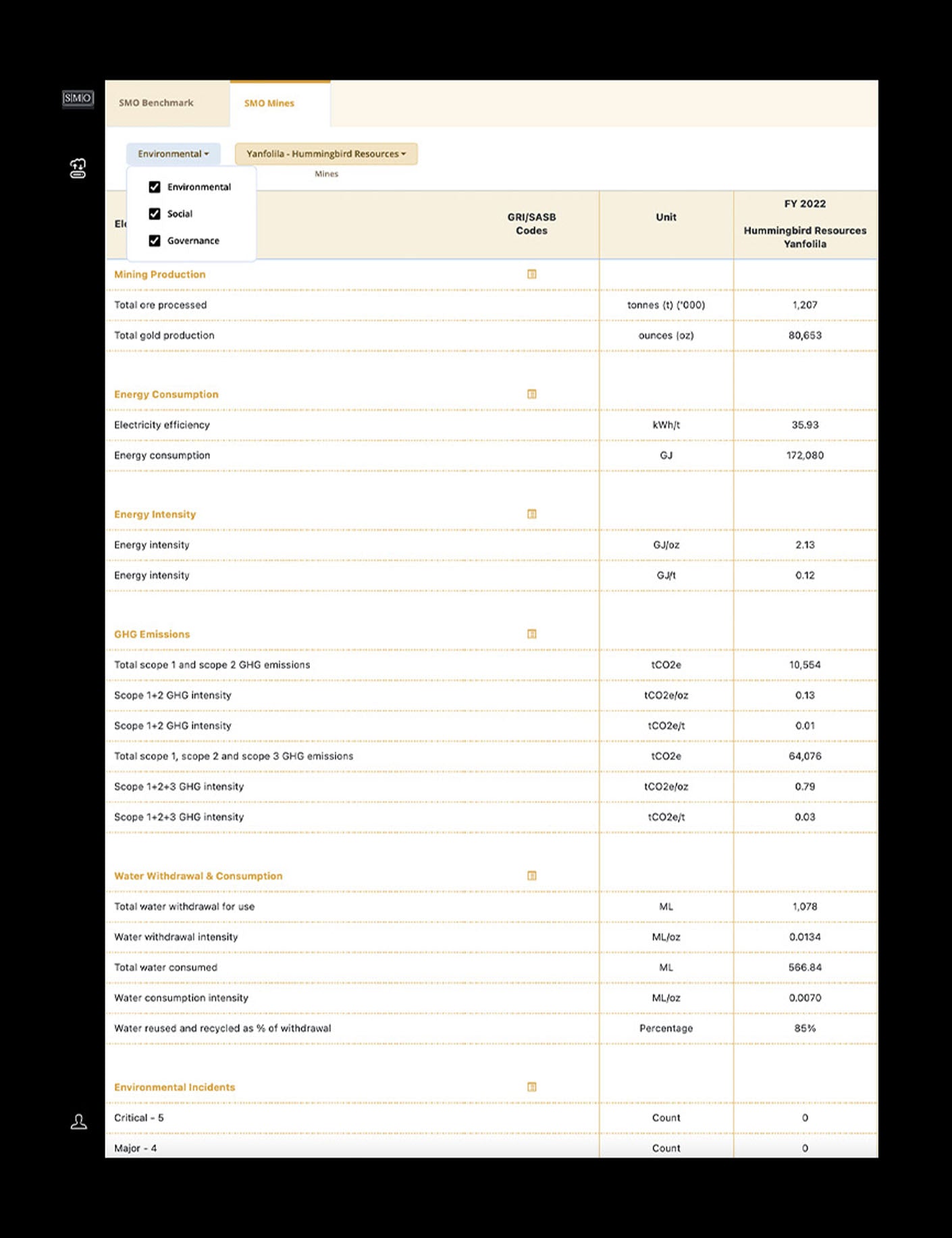

By collating and analysing disaggregated ESG (Environmental, Social, and Governance) data from mining companies’ annual reports, sustainability reports, and other publicly available sources, the SMO ESG Benchmark offers ground-breaking insights into the gold industry’s responsible mining credentials. The benchmark is hosted and curated by Virtua Research, a financial services database company with over ten years’ experience providing financial and operational data for leading companies in the precious metals and mining space.

Transparency & Accountability

BENCHMARK GOALS

We believe that responsible mining practices are key to a sustainable future.

Our mission is to provide unparalleled transparency & accountability, guaranteeing traceability of SMO Gold throughout the supply chain. We are revolutionising how ESG data is produced and consumed in the gold mining sector. Together, we can drive positive change and create a more transparent accountable industry.

- We empower Stakeholders: By making information readily available to investors, regulators, NGOs and consumers to aid informed decision-making.

- We drive Positive Change: By setting industry standards and fostering competition based on responsible practices.

- We enhance Sustainability: By encouraging mining companies to prioritise environmental protection, social responsibility and governance.

CHAMPIONING

RESPONSIBLE MINING

Single Mine Origin is raising the bar for the gold mining sector with an ambitious ESG benchmark to systematically evaluate sustainability credentials.

By introducing a dedicated ESG values-based benchmark, with metrics reported annually, SMO is also increasing transparency and accountability in the gold mining industry.

The Responsible Mining Index's 2022 report highlighted a concerning trend. The majority of the 250 assessed sites, spanning 53 countries, failed to demonstrate public reporting or engagement with communities and workers on basic ESG risk factors and public interest issues.

SMO addresses this gap by collating and analysing disaggregated ESG data against fundamental ESG themes. These themes are mapped back to the UN Sustainable Development Goals (SDG's) and relevant SASB and GRI standards, providing a comprehensive overview of each mine’s sustainability performance.

The SMO ESG Benchmark serves as a critical tool for assessing how SMO-accredited mines compare with other gold mines, both regionally and globally, ensuring that its members stand at the forefront of responsible mining practices.

The SMO ESG Benchmark acts as a catalyst for continuous improvement across the sector. By consistently raising the bar and fostering competition based on responsible practices, SMO aims to inspire positive change, contributing to the overall betterment of the gold mining industry.

Collapsible content

DATA LIMITATIONS

Producing a comprehensive ESG Benchmark comes with its share of challenges, from limited availability of mine-site specific ESG data, diverse reporting standards, to regional variations in mining practices. We have implemented rigorous data collection methodologies, including independent audits and verification processes, to enhance the accuracy and reliability of the SMO ESG Benchmark.

The SMO ESG Benchmark has the following limitations that users should be aware of when interpreting the data:

• Exclusion of Small-Scale, Informal, Artisanal, and Illegal Mine Sites: Obtaining accurate and transparent data from these sources is challenging due to their opaque nature. The benchmark primarily reflects larger, well-managed mines that prioritise transparency and provide comprehensive ESG information to stakeholders.

• Focus on Best Managed and Transparent Mines: This deliberate focus ensures that the benchmark represents a high standard of mining practices. Users should recognise it as an aggregation of top-quartile mining data, reflecting industry-leading operations in terms of environmental, social and governance practices.

• Limited Availability of ESG Data: The dataset is derived from the limited number of mines worldwide providing ESG data at a mine site-specific level. In addition, it is composed of some of the best-managed mines globally, potentially giving the impression of ESG standards that are higher than the broader industry reality.

• Regional Variations: Considerable regional differences exist when comparing mines based in different jurisdictions. It is important to contextualise location when analysing mine-site data against the SMO Global Benchmark as environmental and social factors will significantly impact local metrics. Regional benchmarks will be available in the premium version.

In conclusion, while the benchmark offers valuable insights into the performance of well-managed, transparent gold mines committed to sustainable and responsible practices, it may not fully represent the broader spectrum. Importantly, the benchmarks are intended for reference and comparative analysis, and users are encouraged to consider additional context and factors when making decisions based on this data. It is worth emphasising that the SMO ESG Benchmark predominantly comprises top-performing mines, making it highly unlikely for any single mine to surpass all SMO ESG Benchmark metrics.

DATA SOURCES

The ESG data utilised in constructing the SMO ESG Benchmark is sourced from mining companies’ annual reports, sustainability reports, and other publicly available information, all of which typically undergo independent assurance. The SMO ESG Benchmark is then subjected to a secondary layer of scrutiny through an independent assurance process, ensuring the accuracy and reliability of the presented figures.

Virtua’s data collection team meticulously extracts relevant data from these documents, updating the SMO ESG Benchmark accordingly. All data is traceable back to its source material, and a two-phase review process is implemented to ensure the reliability and accuracy of the data presented in the SMO ESG Benchmark.

Given the disparity in global ESG reporting standards, it is sometimes necessary to manipulate the data to ensure that the SMO ESG Benchmark provides like-for-like comparatives. Consequently, conversions to a standardised unit of measurement are regularly implemented to address these inconsistencies. This process ensures that the SMO ESG Benchmark delivers accurate and meaningful insights for evaluating sustainability performance in the gold mining industry.

The live SMO ESG Benchmark is constantly being updated with the latest ESG data. As a company releases the latest ESG information, this will be added to the benchmark, while the prior year data will fall away. Historic ESG data will be available in the future when the premium version is launched.

PREMIUM LEVEL

SMO is currently in the process of developing an enhanced premium version of the SMO ESG Benchmark with exciting new features, including:

• Regional Benchmarks: initially covering North America, South America, Africa and Asia

• Expanded Data Access: All gold mining ESG data, both SMO and non-SMO, will be accessible on a mine-site level basis, giving users the ability to view and compare data for the entire population of gold mines

• Multi-Mine Selection: Capability to select mines for comparison against each other and/or global/regional benchmarks

• Download Functionality: Users can download data displayed on screen to enable more meaningful data analysis

• Historical Data Availability: Prior-year data will be available (from 2021), enabling comparisons and trend analysis

• Company-Level Data Aggregation: Users will be able to aggregate company-level data and compare it against the SMO Global Benchmark. This feature is designed to cater to analysts interested in evaluating specific companies within the gold mining industry.

Mastering

ESG MINING INTELLIGENCE

The SMO ESG Benchmark is hosted by Virtua Research. We encourage all stakeholders in the gold mining industry to explore the benchmark and leverage its insights for better decisions making.

With over ten years’ experience serving the mining space Virtua is the leading provider of operational and financial data for gold and precious metal Investor Relations websites. Both investors and mining companies rely upon Virtua to provide the most detailed, timely and accurate as reported historical information publicly available.

Built upon years of buy-side and sell-side research experience, Virtua brings together a unique combination of investment knowledge, financial modelling expertise, and software development capability.

Virtua’s strong commitment to both quality and customer service has resulted in it being a trusted partner to many of the world’s most innovative and successful companies.

call attention to

BEST IN CLASS

SMO selects partner mines (SMO Approved Mines) based on stringent criteria to ensure responsible and transparent gold production.

Mines must adhere to SMO’s rigorous ESG standards and comply with frameworks like the Responsible Gold Mining Principles (RGMPs) of the World Gold Council, or equivalent international standards.

SMO thoroughly evaluates each company's ESG performance and mine-site practices, requiring alignment with its benchmarks. Only mines that meet these rigorous criteria earn the "SMO Approved Mines" designation, reflecting their commitment to responsible mining.

DETERMINING

MINE ELIGIBILITY

All member mines must adhere to SMO’s stringent ESG standards.

The term “SMO Approved Gold” refers to gold sourced and produced in line with SMO’s ESG standards and criteria, providing consumers and investors with enhanced ESG scrutiny and insight into their gold’s origin. These ESG criteria evaluate both mining companies and mine-site specific practices and are subject to evolution over time at SMO’s discretion. Certain criteria may not universally apply to all eligible gold sources due to factors such as changes in mining techniques, legal standards, industry standards, or elimination of existing frameworks.

Mining companies and mines adhering to SMO’s ESG criteria, referred to as “SMO Approved Mining Companies” and “SMO Approved Mines,” respectively, must comply with the Responsible Gold Mining Principles (“RGMPs”) established by the World Gold Council (“WGC”) or an equivalent internationally accepted standard. SMO applies the ESG criteria through a multi-level evaluation process, combining objective factors and subjective judgement.

STEP ONE

SMO evaluates mining companies at the corporate level using specific ESG factors, third-party research ratings, compliance with SMO governance metrics, and adherence to industry standards. Companies meeting high standards are recognised as “SMO Mining Companies”.

STEP TWO

SMO assesses each mine location of an SMO Approved Mining Company, considering mine performance against environmental and social benchmarks, application of ESG factors, and the determination of whether the mine operates in a heightened risk or conflict area. Mines in eligible locations can be onboarded as “SMO Approved Mines”, while those in conflict areas undergo enhanced due diligence.

The adaptive approach underscores SMO’s commitment to responsible mining practices, recognising the potential complexities faced by operations in conflict-affected regions.

MEMBER STATUS

APPROVED OR ASSOCIATE MEMBER

SMO only has the capacity to collaborate with a limited number of world-class mines.

However, recognising that numerous mines and mining companies adhere to responsible mining practices and meet SMO’s entry criteria, SMO has established the category of "SMO Associate Member Mines".

While "SMO Approved Mines" & "SMO Associate Member Mines" both meet SMO’s ESG criteria and have demonstrated their commitment to responsible mining practices, only "SMO Approved Mines" are actively engaged with SMO and part of the select group of world-class mines they work closely with.

The Associate Member status may be a temporary designation for mines that meet the criteria due to capacity considerations within the SMO programme at any one time.